If you are new to mutual funds, you will often see a number called NAV. Many investors check this number daily without fully understanding what it means. NAV plays a role in how mutual fund units are priced, but it should not be the only factor when making investment decisions.

This guide explains what NAV is, how it is calculated, why it matters, and what beginners should and should not do based on NAV.

Must Read: What Is a Mutual Fund and How Does It Work?

What Is NAV in Mutual Funds

NAV stands for Net Asset Value. It represents the per-unit value of a mutual fund on a given day.

In simple terms, NAV tells you how much one unit of a mutual fund is worth after accounting for all assets and liabilities.

Every mutual fund scheme declares its NAV at the end of each business day.

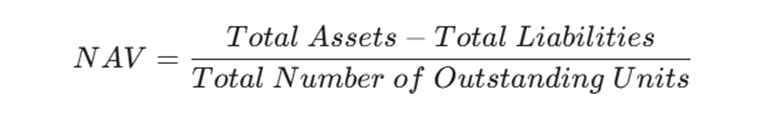

How NAV Is Calculated

NAV is calculated using a simple formula:

NAV = (Total Assets − Total Liabilities) ÷ Total Number of Outstanding Units

What are fund assets

- Shares

- Bonds

- Cash and cash equivalents

- Other investments held by the fund

What are liabilities

- Expenses

- Fees

- Pending payments

Once the calculation is done, the NAV is published for that day.

If this calculation feels technical or confusing, a mutual fund consultant from inXits can explain it with clear examples through their 24×7 free consulting service to help you understand mutual fund basics.

Cut-Off Timings: When Do You Get Today’s NAV

For beginners, this is very important.

Mutual fund NAV depends on cut-off timings:

- Equity Mutual Funds

- If you invest before 3:00 PM on a business day and the payment is realised, you get same-day NAV

- After 3:00 PM, you get next business day NAV

- Debt Mutual Funds

- Cut-off time is 2:00 PM

- After that, next business day NAV applies

Knowing this helps investors avoid confusion when they see a different NAV than expected.

One Mutual Fund Has Two NAVs: Direct vs Regular Plans

Many beginners are not aware of this.

A single mutual fund scheme has two different NAVs:

- Direct Plan NAV

- Regular Plan NAV

Why are they different

- Direct plans have lower expense ratios

- Regular plans include distributor commissions

Over time, Direct Plan NAV is usually higher because fewer expenses are deducted.

This difference does not mean one fund is better than the other. The choice depends on how the investment is made and what support the investor prefers.

Why NAV Matters to Investors

NAV matters because it decides:

- The price at which you buy mutual fund units

- The price at which you sell mutual fund units

However, a lower NAV does not mean a fund is cheap, and a higher NAV does not mean it is expensive. NAV mainly reflects the current value of the fund’s holdings.

Understanding this helps beginners avoid common mistakes.

Does a Low NAV Mean a Better Investment

This is a common misunderstanding.

A mutual fund with a NAV of ₹10 is not better or worse than a fund with a NAV of ₹100. The difference often depends on:

- When the fund started

- How long it has been invested

- How returns have accumulated over time

What matters more than NAV is how the fund fits your goal, time horizon, and comfort with market movement.

How NAV Affects SIP and Lump Sum Investments

NAV and SIP (Rupee Cost Averaging)

In a SIP, you invest a fixed amount regularly.

- When NAV is lower, you get more units

- When NAV is higher, you get fewer units

This process is known as Rupee Cost Averaging, where unit cost averages out over time.

NAV and Lump Sum

In lump sum investments, your investment amount is divided by the NAV on the purchase date to decide how many units you receive.

Example: Why NAV Does Not Decide Profit

| Feature | Fund A (Old) | Fund B (New) |

| NAV | ₹100 | ₹10 |

| Investment | ₹1,000 | ₹1,000 |

| Units Received | 10 Units | 100 Units |

| If Market Grows 10% | ₹1,100 | ₹1,100 |

| Result | Same Profit | Same Profit |

This shows that NAV value alone does not decide returns.

When NAV Changes

NAV changes every business day because:

- Share prices change

- Bond values move

- Market conditions shift

This daily movement is normal and should not cause concern for long-term investors.

NAV and Mutual Fund Returns

NAV growth over time reflects how the fund has performed, but it does not guarantee future outcomes.

Returns depend on:

- Market performance

- Asset allocation

- Fund management decisions

NAV should always be viewed in context, not isolation.

Should You Track NAV Daily

For most long-term investors, daily tracking is not necessary.

You may review NAV:

- During periodic portfolio reviews

- When adding new investments

- When rebalancing your portfolio

Constant tracking can create unnecessary stress.

Common NAV Myths Beginners Should Avoid

Myth 1: Lower NAV means better returns

This is incorrect.

Myth 2: High NAV funds are risky

Risk depends on where the fund invests, not the NAV number.

Myth 3: NAV falling means the fund is bad

Market movement affects NAV daily.

Clearing these myths early helps beginners invest with confidence.

Conclusion

NAV is an important part of mutual fund investing, but it should be understood correctly. It tells you the current value of a fund unit, not whether the fund is good or bad.

Instead of focusing only on NAV, investors should look at goals, time horizon, and comfort with market movement. If you need help understanding NAV or reviewing mutual fund choices, inXits offers clear guidance and 24×7 free consulting to support you at every step.

FAQs

1. What does NAV mean in mutual funds

NAV means Net Asset Value. It shows the per-unit value of a mutual fund.

2. Is a lower NAV better for investment

No. NAV alone does not decide whether a fund is suitable.

3. How often is NAV updated

NAV is updated at the end of every business day.

4. Does NAV include expenses

Yes. Fund expenses are adjusted before NAV is declared.

5. Can I buy mutual funds at the same NAV shown today

Purchases are usually processed at the next declared NAV.

6. Is NAV the same as market price

No. NAV is the calculated value of the fund’s assets per unit.

7. Does NAV affect SIP returns

NAV decides how many units you receive, but long-term results depend on market performance.

8. Should beginners track NAV daily

For long-term goals, daily tracking is not required.

9. Can a mutual fund advisor help me understand NAV

Yes. A mutual fund advisor or consultant can explain NAV clearly.

10. Can inXits help me with NAV-related questions

Yes. inXits provides 24×7 free consulting to help investors understand mutual fund basics.

Mandatory SEBI Warning & Disclaimer

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The securities quoted above are for illustration only and are not recommendatory.